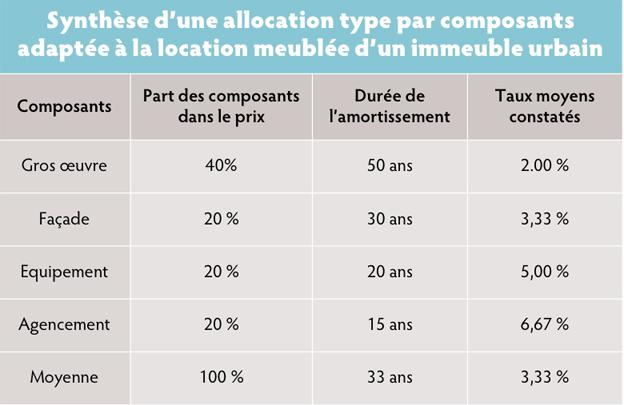

The depreciation of furniture and its duration is a problem that concerns businesses and companies and furnished rental companies.

While the tax authorities define a useful life of 10 years to depreciate these fixed assets, the furnished rental company often depreciates the furniture over a period of 5 to 7 years. Its use is then considered to be more intensive.

Furniture refers to all movable property that can equip or be used to furnish public or private premises.

When its amount is sufficiently large or significant, it is a fixed asset with a limited useful life. Amortization is then done over this normal period of use using the technique of linear amortization.

When should account 2184 be used and furniture depreciated?

Elements that can be included in the furniture (account 2184)

The furniture most often corresponds to what the lawyer calls the "furniture" or "furniture" of article 534 of the code civil.

In a company, the term can refer to office furniture (cabinets, desks, chairs, etc.). In a restaurant, it will be tables and chairs for example.

For the furnished rental company, it will often be all the furniture that is made available to a tenant (bed, table, chair, sofa, shelf, cupboard, kitchen furniture, etc.).

Furniture: fixed asset to be depreciated or expense?

Choosing between an expense account and a fixed asset account for furniture is not always easy. The amounts involved are sometimes so low that they can be considered insignificant, especially when they do not exceed the threshold of €500.

Furniture does, however, fall within the definition of an asset and in this sense it should be depreciated except for low value assets.

A tolerance from the tax administration concerns both small equipment and tools, office equipment, office furniture. And according to a ministerial response of December 10, 2001, the tolerance concerns small equipment (wastepaper baskets, staplers... but also office furniture or commercial shop furniture. The unit value must be less than €500.

Here, the posting in a fixed asset account remains mandatory in the event of complete renewal of the furniture in a room or a store. The low unit value is then no longer taken into account unless the total value does not exceed this amount.

Thus, a company that decides to acquire a dozen desks and chairs for its employees must in principle immobilize and depreciate them. The rule is the same when all the furniture in a room is acquired at once or renewed at the same time.

It is only in the event of the isolated renewal of a limited number of goods that the tolerance may possibly apply. It avoids the posting of accounting depreciation.

The depreciation method for furniture and its duration

The depreciation allowance for furniture is generally quite simple to calculate since the technique is that of straight-line depreciation calculated at the end of the financial year .

This is the mandatory minimum that is applied by default when no other method of depreciation is provided. As such, declining balance depreciation does not apply to furniture and there is no exceptional depreciation.

The straight-line depreciation period for furniture may vary from company to company. It can be defined according to the duration of use in the VSEs.

This duration of use is given by the tax authorities and is set at 10 years for a depreciation rate of 10%.

The depreciation period will generally be shorter for low-value furniture whose lifespan is more limited or in the case of furnished rental companies who use it more intensively.

This is how an amortization period set at 5 or 7 years can then be accepted.

Recognition of depreciation of furniture

Recognition of depreciation of furniture is done in the accounts provided for by the PCG. Account 2184 “furniture” is generally associated with an account 68112 “Depreciation of property, plant and equipment” and an account 28184 for the depreciation of furniture.

As part of its consultation on the modernization of financial statements, the ANC proposes to remove this last account from the list of accounts in the chart of accounts. Only an account 281 “depreciation of tangible fixed assets” would still be expressly provided for. It could be broken down in the same way as account 21.

As a reminder, companies must depreciate depreciable fixed assets as soon as they are put into service. Otherwise, the depreciation may be permanently lost and the net book value will remain identical to the historical cost.