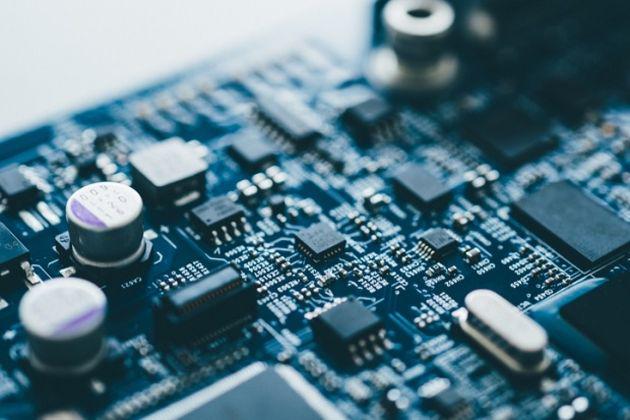

Semiconductors have been having the news for two years now.Covid's pandemic and the supply tensions that she has drawn highlighted our dependence on these small chips (chips in English).European and Western states have realized that their industries, automotive, high technology and digital, were ultra-dependent on only two or three countries.

Indeed, today the largest flea producers are located in Asia.Taiwan largely dominates with 63 % of market shares, especially through the TSMC giant.At their three, Taiwan, South Korea and China hold 87 % of the world semiconductor market, which was worth around 550 billion dollars in 2020 and is expected to double by 2030 to reach $ 1,000 billion.

With this observation, the EU and the United States are trying to attract investors and semiconductor manufacturers to their territories.The American House of Representatives submitted a Creating Helpful Incentive to Produce Semiconductors (Chips) project last January.The European Commission has followed suit by proposing its own chips Act.

The project is still at a little advanced stage.But the major economic powers are mobilizing to no longer depend on South Korea or Taiwan and put significant sums on the carpet: $ 52 billion over 6 years for Americans, 150 billion over 10 years for Chinese and 43 billioneuros over 8 years on the European side - but part of which has already been swallowed by the recovery plan.Americans already have a more developed semiconductor industry and leaders in this area, as Intel.A question, however, remains: can we structure an industrial sector with a simple law?

A very technocratic text

The text of the Commission is a very technocratic tool for the orientation of funding and subsidies to the industrial players of flea markets that would settle in Europe.Its plan comes up against several obstacles and first of all to that of Asia's quasi-monopoly on the semiconductor production market.This part of the world is a huge consumer: in 2020, smartphones and computer science consumed for $ 210 billion in chips!Unsurprisingly, smartphones are mostly produced in China (more than 50 % of smartphones worldwide) followed by India and Vietnam.Europe is very far away, it is above all a big importer.

For the situation to change, it would be necessary in a way to create a chain of European values, from production to demand.On this aspect, the text clearly lacks its objective.Europe has certainly kept a strong automotive industry, a large consumer of fleas, but cars consumer only need low technological chips.Only luxury models or very sharp technology, like Tesla, require more developed fleas.It is difficult to see how Europe could make entry -level fleas without being able to compete with China.

The lack of global approach to the text

Second, the Commission says nothing about the training.Semiconductors require a qualified, even very qualified workforce for the smallest chips.Korea and Taiwan have understood this.Their high -performance university system gives a large place to training in industrial professions.In addition, there are very strong links between companies and universities through technological clusters.A too neglected aspect in the EU except in Germany, the Netherlands and Sweden.

Some players in the sector are however eager to settle in Europe, in countries-there are a few-which have adequate industrial fabric and a skilled workforce, the high cost of labor n 'being not a brake because a product with high technological value is sold expensive.But they point to administrative heaviness, whether national or community.For the installation of a flea manufacturing plant, administrative authorization procedures in France can take more than two years.

Very long too, and time -consuming for business staff, are the steps to obtain European funding.There is therefore a risk that manufacturers will only settle in a few countries, the most flexible: Tesla for example has chosen Germany for its gigafactory.The commission seems to have received the message, it has provided an administrative simplification component in its chips Act.Perhaps the announcement of Intel, 80 billion investment in Europe to develop production infrastructure in the next ten years, is also something for something.

To conclude, the Act chips appears to be ambitious but remains little concrete and grants too good part in planning.The French vision, embodied by the Breton Commissioner, won over the more liberal vision of Commissioner Vestager.In addition, the Commission, for the production of cutting-edge semiconductors, targets 20 % of the world market in 2030 against 10 % today.However with the needs that will double in 2030, it would be necessary to multiply it by four.Possible, perhaps.But for the moment, the goal seems difficult to achieve.

-

On the Web